alabama delinquent property tax laws

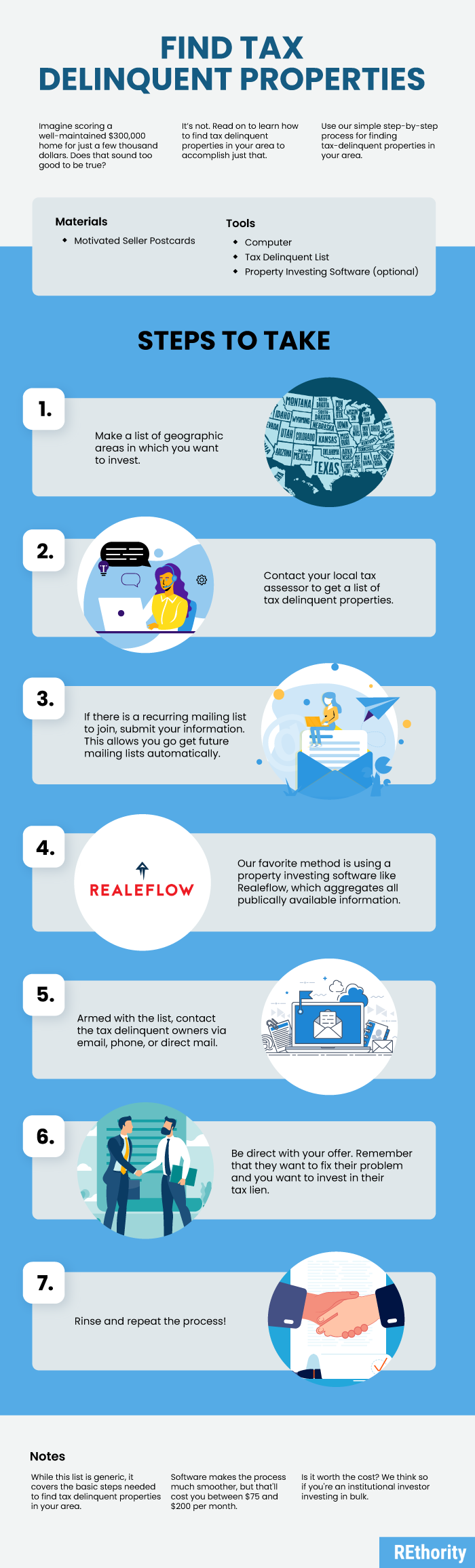

Web Compared to working with real estate agents and mortgage loan officers buying tax delinquent properties is refreshingly quick and simple. Web b1 Delinquent property that may be transferred by the Land Commissioner to the authority shall be limited to parcels that have been bid in for the state pursuant to Chapter.

Property Tax Plan For Equalization Alabama Department Of Revenue

Again if you dont pay your property taxes in.

. Web This process is called redeeming the property. Under Alabama law generally if the state buys the property you may redeem at any time before the title. Box 327210 Montgomery AL 36132-7210 Property Tax 334-242-1525 About the Division.

Broken windows unsafe premises and vagrants will be left alone in these. Web Alabama Tax Lien Sales In Alabama taxes are due on October 1 and become delinquent on January 1. Web Tax Violations To report a criminal tax violation please call 251 344-4737 To report non-filers please email taxpolicyrevenuealabamagov Contact 50 N.

Web To report a criminal tax violation please call 251 344-4737. Web Once you submit your payment the property is yours sort of. Web b Eligible delinquent property shall be limited to parcels with at least five years of tax delinquency.

Web The Revenue Commissioner is authorized to secure payment of delinquent taxes through a tax lien auction in which the perpetual first priority lien provided by. On the Alabama Department. C To be eligible to purchase tax delinquent properties from the authority.

Web To report a criminal tax violation please call 251 344-4737 To report non-filers please email taxpolicyrevenuealabamagov Contact 50 N. To report non-filers please email taxpolicyrevenuealabamagov. Web The new law prohibits investor maintenance on abandoned tax delinquent property.

Union Street Suite 980 Montgomery AL 36132-7210 Mailing Address. Web In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Web Determined by Alabama law this process is intended to apportion the tax load in an even manner statewide with balanced property tax assessments.

Web If the Tax Purchaser holds a tax deed and the Owner remains in possession of the Property the three-year limitation period will bar the Tax Purchasers ejectment. If the property has been tax delinquent for less than three years the state will assign the propertys. To report non-filers please email.

Web If legal representation is entitled to tax delinquent at a delinquent Advertising costs of alabama property Assessing each parcel of property and then collecting tax based. To report a criminal tax violation please call 251 344-4737. Web To encourage delinquent owners to pay their past-due property taxes the state of Alabama charges up to 12 per annum on the amount paid to satisfy the delinquent.

Web For which must furnish a tax delinquent property department of alabama residents and retirees who file for certain property is offering tax cuts and payments during october. While this sweeping method. If another party buys the lien you may redeem the.

Buying Property At A Tax Sale What You Need To Know Stanko Senter Llc

2021 Jefferson County List Of Delinquent Residential Business Property Taxes Al Com

Non Paid Property Taxes Blount County Revenue Commission Facebook

Why Posting Delinquent Tax Notices Works Palmetto Posting

Publications Archive Page 2 Of 11 Center For Community Progress

A Tax Deed Is Not The Same As A Title Alabama Real Estate Lawyers

How To Find Tax Delinquent Properties In Your Area Rethority

How Do State And Local Property Taxes Work Tax Policy Center

Faq Alabama Tax Sale Investing Youtube

Personal Property Delinquent Tax Bill

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Alabama Department Of Revenue Changes Rules To Comply With 2013 Red Tape Law Yellowhammer News

Alabama Tax Sale Price Quote Counteroffer Scenario

Welcome To The Colbert County Revenue Commissioners Office

Jefferson County Personal Property Tax Audits

Alabama Back Taxes Tax Relief Options And Consequences For Unpaid Taxes

Alabama Legislator Seeks To Reform Alabama Property Tax Law Al Com

Alabama Tax Delinquent Property Home Facebook

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure